Swimming pools in Egypt are no longer just a luxury for a handful of hotels and villas. Between booming construction, a tourism rebound, and the customer appetite for time-saving smart home devices, 2025 is shaping up to be a turning point for automated pool maintenance — especially robotic pool cleaners. This article explains the market context in Egypt, quantifies the opportunity, details the technology and commercial trends shaping demand for robotic cleaners, and gives practical recommendations for manufacturers, distributors, and hoteliers who want to win in this fast-growing segment.

Snapshot: size and direction of the market (what the numbers say)

Several recent market reports and economic data points paint a consistent picture: Egypt’s built environment and leisure sectors are expanding, and specialized pool equipment is following that growth.

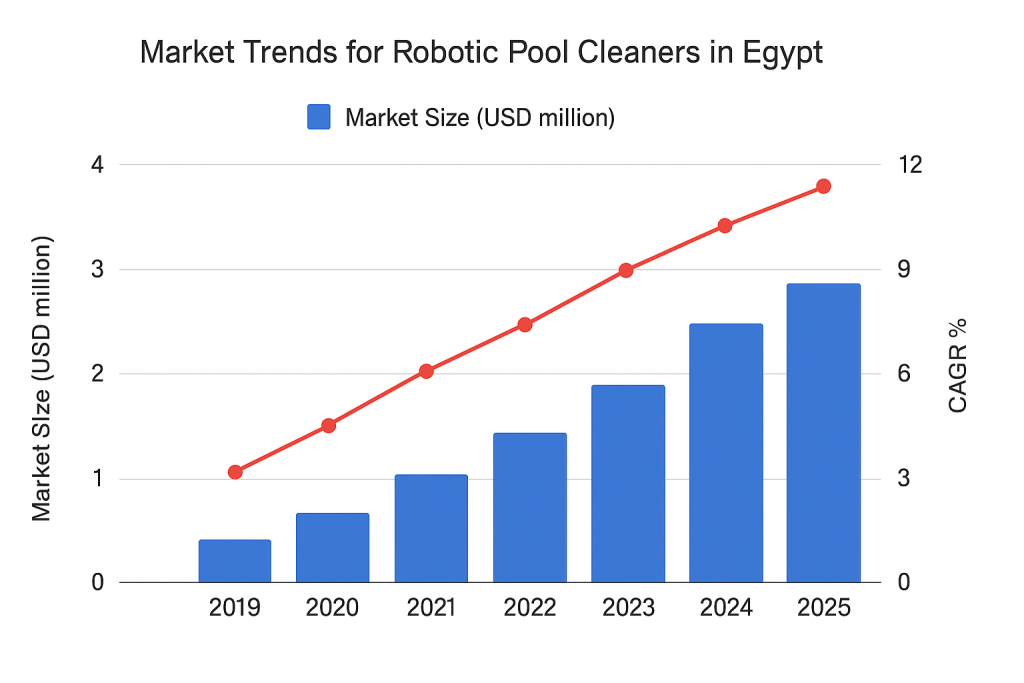

- Market research estimates the robotic pool cleaner market in Egypt at about USD 3.30 million in 2025, with a projected double-digit CAGR through the next decade as adoption rises across residential and commercial segments. Cognitive Market Research

- Regionally and globally, robotic pool cleaners are increasingly prominent within the overall pool-equipment universe. Industry data places the global robotic pool cleaner market in the low-to-mid billions for 2025, with forecasts showing strong mid-single to double-digit annual growth driven by automation and energy efficiency trends. (For example, global market projections vary by source — one estimate shows roughly USD 2.17 billion in 2025 while another research house reports ~USD 1.1 billion; both agree on solid year-over-year growth.) Fortune Business Insights+1

- Separately, the wider Egyptian swimming-pool equipment market is also tracked in market databases at roughly USD 29–30 million in 2025, which provides context for how robotic cleaners fit into total pool spending. Cognitive Market Research

Those headline numbers matter because they show Egypt as a meaningful but still nascent market for robotic pool cleaning tech — large enough to attract foreign suppliers and to support local distribution, but still with plenty of room for market share gains by early movers.

Why Egypt? Macro tailwinds that help pool equipment sales

Four structural factors in Egypt combine to create favorable conditions for investment in pool automation:

- Construction and real-estate investment — Egypt has important public and private construction activity in 2025, including new housing, tourism infrastructure and renewable energy projects that support broader economic expansion. Several industry trackers forecast healthy growth in construction output for 2025, which in turn drives demand for pools in new hotels, resorts, compounds and private villas. GlobeNewswire+1

- Tourism rebound — Tourism has recovered strongly following pandemic disruptions. Tourism growth fuels hotel renovations, resort upgrades and new pool projects — prime buyers of commercial robotic cleaners that can cut labor and chemical costs while delivering consistent cleanliness. National statistics and economic reporting for 2024–2025 show tourism among the sectors with above-average growth contributions. Reuters

- Rising household income & urban luxury living — Egypt’s middle and upper-income segments have expanded over the past decade, particularly in major urban areas and gated developments around Cairo, Alexandria, and the Red Sea resorts. Private villas and compound living often include pools, and these homeowners increasingly prefer low-maintenance, smart appliances.

- Operational pressures: labor, water and energy — Hotels and clubs in Egypt face labor cost pressures and increasing scrutiny on water usage and chemical consumption. Robotic cleaners that are energy-efficient, minimize chemical recirculation, and can reduce manual labor time offer a clear operational ROI for commercial buyers.

Together these macro trends mean suppliers who position robotic cleaners as cost-saving, water-conserving, and labor-reducing solutions can accelerate adoption across both commercial and private channels.

Who buys robotic cleaners in Egypt — buyer segmentation

Understanding who the buyers are clarifies product, pricing and channel strategy:

- Hotels and Resorts: Large pools (lap pools, infinity pools) and an imperative for consistent water quality make resorts an early adopter. Commercial units with heavy-duty brushes, extended runtime and robust warranties are favored.

- Property Developers & Management Companies: New gated communities often centralize maintenance purchasing; these buyers want durable equipment, spare-parts availability, and bulk service deals.

- Private Villas & High-end Homes: Affluent homeowners seek convenience; cordless or light-weight robotic cleaners that work on pool walls and floors are appealing.

- Public Clubs & Sports Centers: Demand revolves around reliability, uptime, and the ability to handle high bather loads.

- Retail / E-commerce Shoppers: As online retail and social commerce expand in Egypt, consumer-grade robotic cleaners with strong digital marketing presence are increasingly purchased through marketplaces and specialty pool retailers.

Targeting each of these segments requires different product specs and different commercial approaches (B2B tendering vs. D2C marketing).

Product & technology trends shaping 2025 demand

Several technology trends are driving both the appeal and the requirements for robotic pool cleaners in 2025:

- Smarter navigation & mapping — Advances in on-board sensors, SLAM (simultaneous localization and mapping), and better algorithms mean modern robots cover pools more completely, avoid getting stuck, and reduce cycle times. For commercial buyers, improved mapping reduces cleaning gaps and cut cycle counts.

- Longer battery life & fast charging — Lithium battery improvements (energy density, battery management systems) allow cordless units to run longer between charges and complete larger pools without needing booster pumps — a major selling point for residential customers who dislike tethered systems.

- IoT & remote management — Connectivity features let facility managers monitor performance, schedule cleaning, and receive service alerts remotely. In hospitality and property management, this lowers reactive maintenance and helps centralize service.

- Energy & water efficiency — Manufacturers emphasize low power draw and hydrodynamic designs that minimize backwash and chemical consumption — features increasingly attractive to Egyptian buyers sensitive to utility and water costs.

- Modular, serviceable designs — Local repairability matters in markets where importing parts is time-consuming. Suppliers that provide local spare parts, step-by-step repair guides, or training for local technicians can win long-term contracts.

- AI-driven diagnostics & predictive maintenance — Some premium robots include self-diagnosis that predicts motor or battery issues, reducing downtime — a clear value proposition for commercial customers.

These trends mean product lines split into tiers: heavy-duty, warranty-focused commercial robots; mid-range semi-professional units for compounds and clubs; and cost-conscious, easy-to-use consumer models for private pools.

Price points, margins and channels — how robots get to customers

Typical market realities (observed globally and in similar regional markets) that apply to Egypt:

- Price bands:

- Entry consumer robotic cleaners: USD ~300–700

- Mid-range (home & small commercial): USD ~700–1,500

- Commercial/professional robots: USD 1,500–6,000+ depending on specs

- Margins:

- Retail margins on consumer units sold through marketplaces and specialty dealers are moderate; distributors and dealers must justify inventory by offering after-sales service and training.

- B2B contracts (hotels, resorts) often involve service agreements and spare-parts contracts that yield higher lifetime value.

- Channels:

- Direct B2B sales via tenders and facility management networks (important for hotels and developers).

- Distributors & specialty retailers who provide installation and maintenance.

- Online marketplaces & social commerce for consumer units — growth here is rapid in the Middle East and North Africa.

- After-sales and service networks are a core competitive moat in Egypt given logistical and parts-availability concerns.

Local partners that can offer warranty fulfillment, spare parts stocking and technician training create the confidence buyers need to move from manual cleaners to robotic solutions.

Regulatory, safety and certification considerations

Because robotic pool cleaners are electrical devices that operate in or near water and often include lithium batteries, Egyptian importers and buyers prioritize familiar certifications:

- Electromagnetic and electrical safety (CE is widely recognized; UL/ETL or equivalent may be required by some hotel chains).

- Battery safety (UN 38.3 for lithium battery transport; safe battery management to reduce fire risk).

- IP rating and waterproofing to ensure durability in chlorinated water.

- Local customs & import documentation — importers should confirm harmonized tariff codes and applicable VAT/exemptions for hotel equipment.

Suppliers that can show recognized international certifications and provide clear test reports speed up procurement for large buyers.

Supply chain realities and sourcing advice

Most robotic cleaners sold in Egypt are sourced from Asia — primarily Chinese manufacturers — because of cost competitiveness and OEM/ODM flexibility. For market entrants and distributors:

- Stock critical spare parts locally (motors, brushes, power adapters, filtration cartridges) to shorten downtime.

- Negotiate warranty & return terms that are realistic for Egyptian logistics (consider local service centers).

- Local assembly or rebranding options (light assembly, packaging, software localization) can reduce customs and improve perceived local support.

- Train technicians and build a certified service partner program to reassure big-ticket buyers.

Given the projected growth in the Egyptian pool equipment market, early investment in after-sales service often pays off more than small price discounts.

Market risks & constraints to watch

Adoption in Egypt will not be frictionless. Key constraints include:

- Price sensitivity among many private buyers — low-cost manual options remain competitive.

- Awareness & trust gap — many smaller hotels and private owners still prefer known manual methods or local cleaners. Marketing must demonstrate ROI (time saved, chemical and energy savings).

- Currency & import volatility — Egyptian importers face currency risk and potential shipping delays; strategies like hedging or local stocking help mitigate this.

- Competitor landscape — international brands, regional distributors and local aftermarket suppliers will compete on price, service, and brand recognition.

Addressing these risks often requires a mix of localized marketing, clear ROI case studies, and strong field support.

Practical go-to-market recommendations (for suppliers & distributors)

- Create ROI case studies for hotels — show time saved, reduction in manual labor hours, and chemical savings across 6–12 months. Hard numbers sell to procurement teams.

- Offer commercial service contracts — fixed-price annual service with spare parts included will be attractive to resorts and property managers.

- Localize support — establish a certified technician network in Cairo, Alexandria and Red Sea resort areas (Hurghada, Sharm El Sheikh). Fast service is a major differentiator.

- Tier your product portfolio — a durable commercial line, a mid-range model for compounds, and a simple consumer model for direct online sales works well.

- Educate the market — run demos at trade shows, pool-industry conferences, and property-developer seminars; show live before/after cleaning cycles.

- Partner with pool contractors and chemical suppliers — alignment with installers and chemical providers unlocks cross-sell opportunities (new pool builds, seasonal upgrades).

The outlook: 2025–2030 (what to expect)

Given the macro drivers (construction growth, tourism, operational pressure), and the global technology momentum behind robotic cleaners, the Egypt market is likely to see:

- Incremental adoption in commercial sectors (hotels, clubs) in 2025–2026, driven by procurement cycles and demonstrable operational savings.

- Faster growth among gated communities and high-end private buyers by 2026–2028, as battery-powered cordless robots and e-commerce adoption rise.

- A compounding market size that outpaces overall pool equipment growth thanks to the automation premium (higher average selling prices for robots vs. manual vacuum kits).

Market research projects and industry data support a pattern of double-digit percentage growth for robotic pool cleaners in the Middle East and North Africa region through the late 2020s — Egypt is well positioned to match regional growth given its tourism recovery and construction pipeline. Cognitive Market Research+1

Final thoughts: what winning looks like in Egypt, 2025

Winning in Egypt’s robotic pool cleaner market in 2025 means more than selling an appliance. It requires:

- Demonstrable operational ROI (show the numbers for hotels and property managers).

- Reliable local service, spare parts availability and warranty fulfillment.

- Product fit across three tiers (commercial, mid-range, consumer).

- Clear messaging around water/energy savings and reduced labor exposure — these themes resonate strongly with commercial buyers.

Suppliers that combine a competitive product, local presence, and strong B2B case studies will capture an outsized share of the emerging robotic pool cleaner market, while distributors who invest in training and local technical capabilities will lock in long-term recurring revenue.

Sources & further reading

- Egypt Robotic Pool Cleaner market estimate (2025) — Cognitive Market Research (Egypt market size USD 3.30M, regional growth forecasts). Cognitive Market Research

- Global robotic pool cleaner market projections and CAGR overview — Fortune Business Insights (global market sizing, 2025 figures). Fortune Business Insights

- Alternative market sizing and growth perspective for robotic pool cleaners — The Business Research Company (global market and CAGR estimates). 商业研究公司

- Egypt swimming pool equipment market size (contextual figure ~USD 29–30M in 2025) — Cognitive Market Research (swimming pool equipment breakdown). Cognitive Market Research

- Egypt macro environment: GDP, tourism and sector performance (2024–2025 reporting showing tourism growth and GDP figures) — Reuters reporting on Egypt’s Q2 growth and tourism. Reuters

- Egypt construction industry outlook and 2025 growth expectations — GlobalNewsWire / Yahoo Finance reporting and sector research. GlobeNewswire+1