Definition & Product Segmentation

Above-ground pools are portable alternatives to in-ground installations. Their core advantages—mobility, rapid set-up, and compact storage—have made them a staple of summer family life worldwide. Today’s market offers three distinct tiers:

• Inflatable pools –an air-ring or air-tube design with a PVC liner.

• Frame pools – galvanized-steel tubing plus resin connectors and a reinforced liner.

• Premium pools – rigid steel or resin walls, upright posts, coping, skimmers, and matching accessories such as ladders and sand filters.

Most accessories (filters, ladders, covers, etc.) are cross-compatible across the three categories.

A Brief History of the Industry

2.1 Birth & Early Growth (1930s–1940s)

• 1930s: German forces used rubberized “water bladders” in North Africa—an improvised solution for both potable water and desert bathing.

• Post-war: Italian engineers replaced the rubber ring with a light steel frame, giving birth to the first frame pool.

• Late-1940s: Manufacturers experimented with fiberboard, aluminum, and early galvanized steel, but filtration systems were still absent.

2.2 Material & Technical Refinement (1950s–1970s)

• Mid-1950s: Resin-coated steel walls, zinc-plated frames, and vinyl liners improved durability.

• 1958: The first integrated filtration kits appeared, turning seasonal splash pools into semi-permanent backyard amenities.

• 1960s–1970s: Structural diversity blossomed—round, oval, and rectangular shapes—while U.S. retail chains popularized the category.

2.3 Safety Standards & Product Sophistication (1980s–Present)

• 1980s: Rising safety concerns led to collaboration between manufacturers and consumer-safety commissions, birthing the first ASTM and CEN standards.

• 1987: Resin composite frames delivered higher strength at lower weight, triggering a wave of premium offerings.

• 1990s–2000s: Light-gauge steel and advanced polymers enabled larger, deeper pools without commensurate weight penalties.

• 2000s–Today: China’s manufacturing ascendancy shifted global production, creating a “Made in China, Enjoyed Globally” value chain.

Current Global Market Snapshot

3.1 Market Size & Growth

• 2017: USD 0.90 B

• 2019: USD 1.03 B (CAGR 2017-19: 6.98 %)

• 2020-21: Lockdown-driven demand pushed 2021 revenue to USD 1.68 B (+63.5 % vs. 2019)

• 2022: Geopolitical tensions and inflation trimmed growth, but the multi-year uptrend remains intact.

• Forecast: The market is expected to surpass USD 3.0 B by 2027.

3.2 Product Mix

• Frame pools: 59% of 2021 sales (largest segment)

• Inflatable pools: 39 %

• Premium pools: 2 % (nascent but high-margin)

3.3 Regional Demand

Europe – birthplace of the category, 47 % of global sales in 2021.

North America – culture of backyard living, 30% share.

Combined, Europe & North America account for >70 % of worldwide demand.

Profitability Trends

Despite raw-material volatility (galvanized steel, PVC), the industry has maintained stable margins because:

• Consumers treat pools as discretionary lifestyle products with low price sensitivity.

• Brand equity and seasonal scarcity allow manufacturers to pass through cost inflation.

Going forward, companies with strong brands, lean digital supply chains, and R&D depth will widen their profit spread.

Future Trajectories

5.1 Rapid Expansion of Premium Pools

Installation time has fallen below two hours thanks to lighter panels and click-lock systems. High-net-worth households increasingly view premium above-ground pools as a cost-effective alternative to in-ground construction.

5.2 Smart & Connected Pools

IoT sensors, mobile apps, and cloud dashboards now track water temperature, pH, ORP, and filter life. Predictive analytics triggers automatic chemical dosing and even subscription-based cartridge deliveries—early-stage but high-potential.

5.3 Factory Digitization

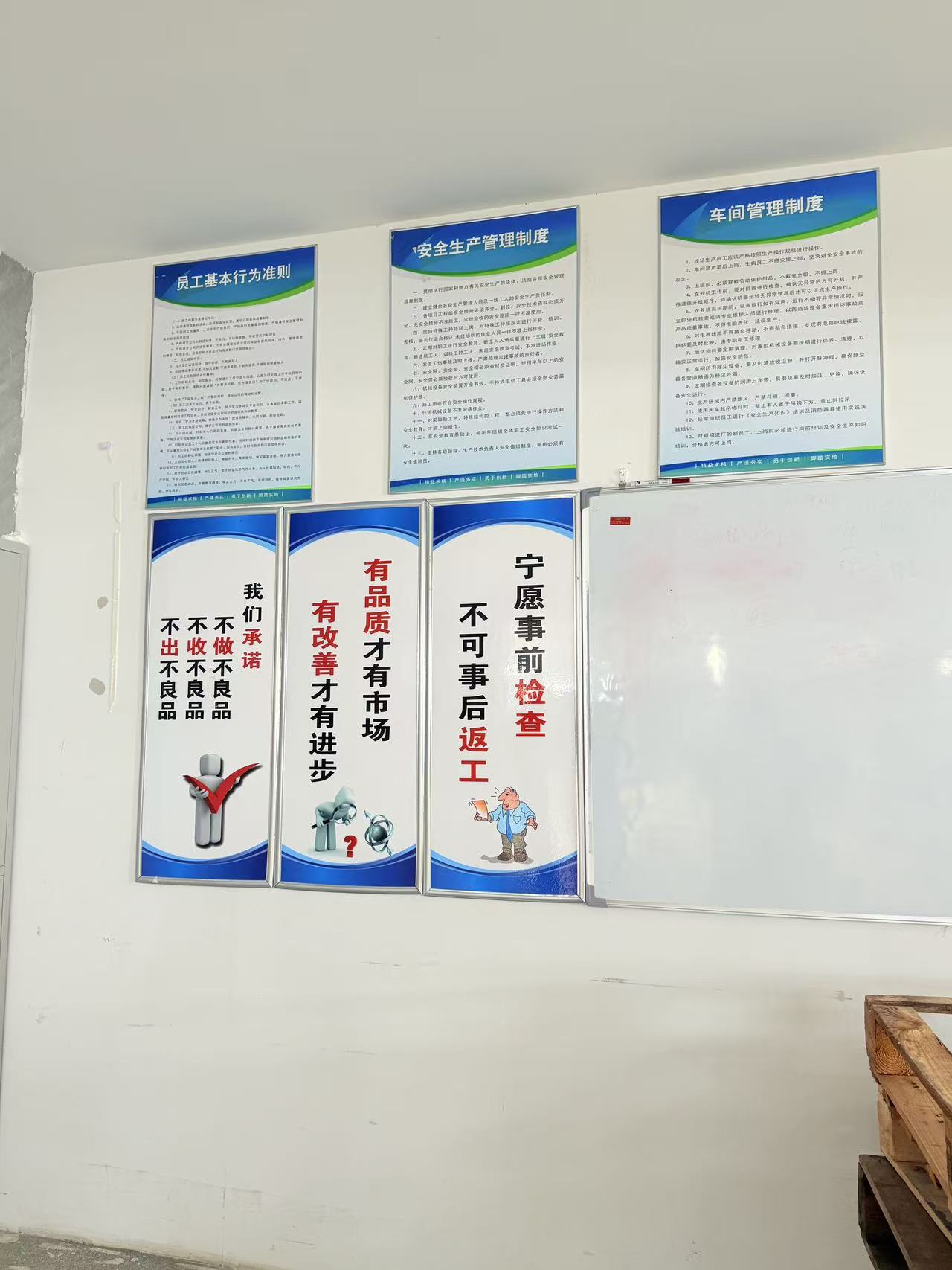

Leading Company OEMs have deployed MES, digital twins, and AI-based demand forecasting. Benefits: shorter lead times, lower inventory, and higher first-pass yield. Expect a widening efficiency gap between digital leaders and legacy plants.

5.4 Design & Aesthetic Personalization

Because pools occupy prime backyard real estate, consumers demand both ease of assembly and visual harmony with landscaping. Modular wall panels, faux-stone or wood-grain finishes, and color-customizable liners are becoming key differentiators.

From wartime water bladders to AI-monitored backyard oases, above-ground pools have evolved into a resilient, innovation-driven segment. With premiumization, smart technology, and Chinese manufacturing prowess converging, the next five years promise both robust growth and a reshuffling of competitive ranks.